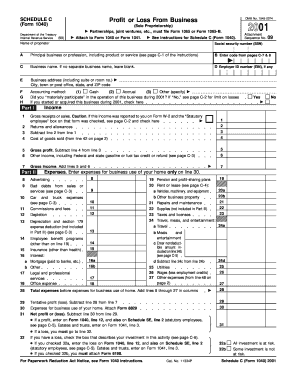

If you have a loss check the box that describes your investment in this activity see instructions. It is used by the united states internal revenue service for tax filing and reporting purposes.

Schedule 1 form 1040 line 12 or.

Sample schedule c tax form. Schedule c profit or loss from business is part of the individual income tax return irs form 1040. This form must be completed by a sole proprietor who operated a business during the tax year. Anyone in business as an independent contractor or a sole proprietor needs to file an addendum to your personal tax statement form 1040 called schedule c.

Estates and trusts enter on. Form 1041 line 3. Schedule se line 2.

This form can be used by an organization to calculate its profit and losses in accordance with the tax laws and then submit these to the taxation department. A schedule c is a supplemental form that will be used with a form 1040. Form 1040 line 12 or.

The resulting net profit or loss of the business found on line 31 is then reported beginning with 2018 taxes on schedule 1 line 12. Sample schedule c tax form. The format followed is defined and guarded by the taxation law making the process simpler.

You can not file schedule c with one of the shorter irs forms such as form 1040a or form 1040ez. Form 1040nr line 13 and on. If a loss you.

Your loss may be limited. Schedule se line 2. Page one of irs form 1040 and form 1040nr requests that you attach schedule c or schedule c ez to report a business income or loss.

This form is known as a profit or loss from business form. It shows the income of a business for the tax year as well as deductible expenses. Estates and trusts enter on.

Its used to report income for a sole proprietorship or single member limited liability company llc. If you checked the box on line 1 see instructions. Estates and trusts enter on.

Go to line 32 31. If you checked 32b you. If you checked the box on line 1 see the line 31 instructions.

Schedule 1 form 1040 or 1040 sr line 3 or. You may also see payroll tax forms. While your 1040 is a statement of all of your personal income the schedule c form is a detailed record of your business income and business expenses.

Schedule se line 2. If you checked the box on line 1 see instructions. All investment is at risk.

Form 1041 line 3. Some investment is not. Form 1041 line 3.

If you have a loss check the box that describes your investment in this activity see instructions. Form 1040 nr line 13 and on. Go to line 32 31.

The irs schedule c form is the most common business income tax form for small business owners. Information about schedule c form 1040 profit or loss from business sole proprietorship including recent updates related forms and instructions on how to file. Form 1040nr line 13 and on.

Schedule c form 1040 is used to report income or loss from a business operated or a profession practiced as a sole proprietor. If a loss you.

0 Response to "Sample Schedule C Tax Form"

Post a Comment