India individual sample personal income tax calculation. Please find below two 2019 gross to net calculations one with and one without the 30 ruling.

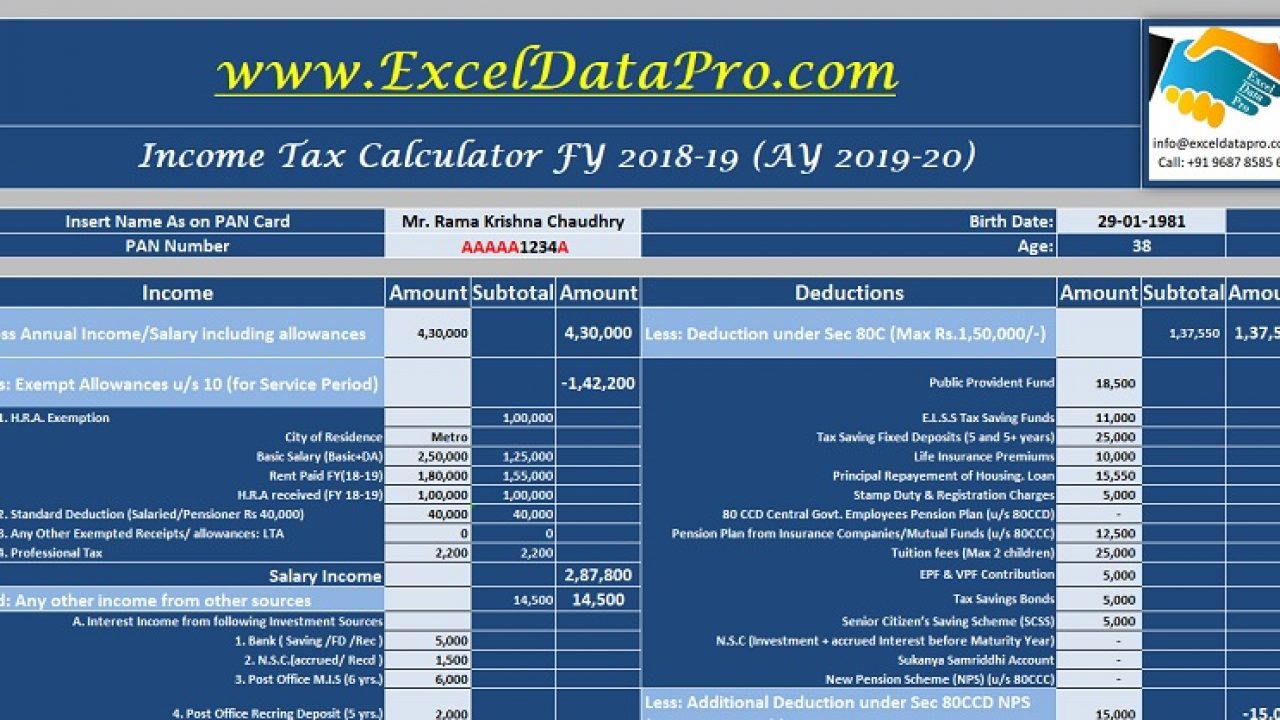

We highlight the changes and give you the new tax calculator for fy 2017 18 ay 2018 19.

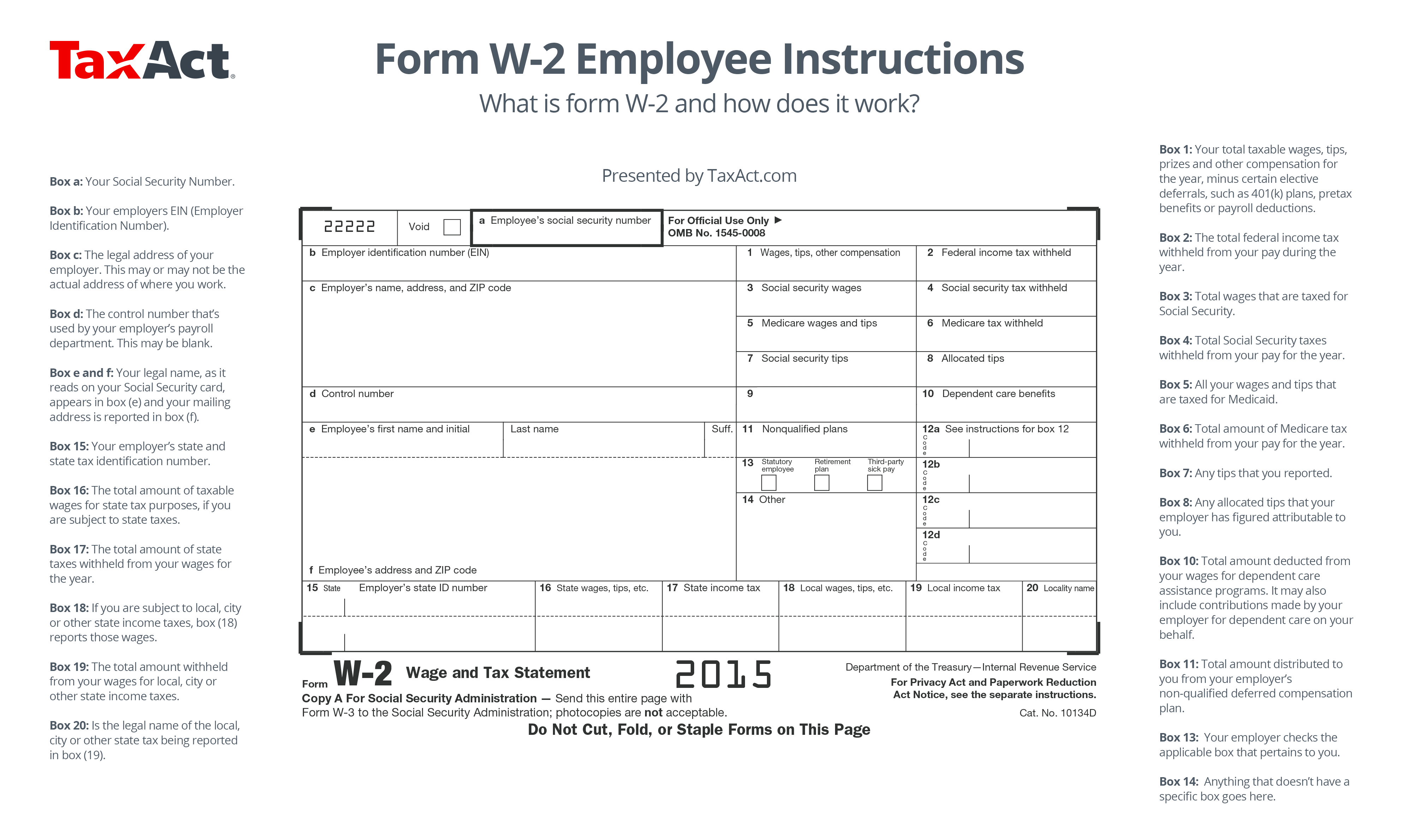

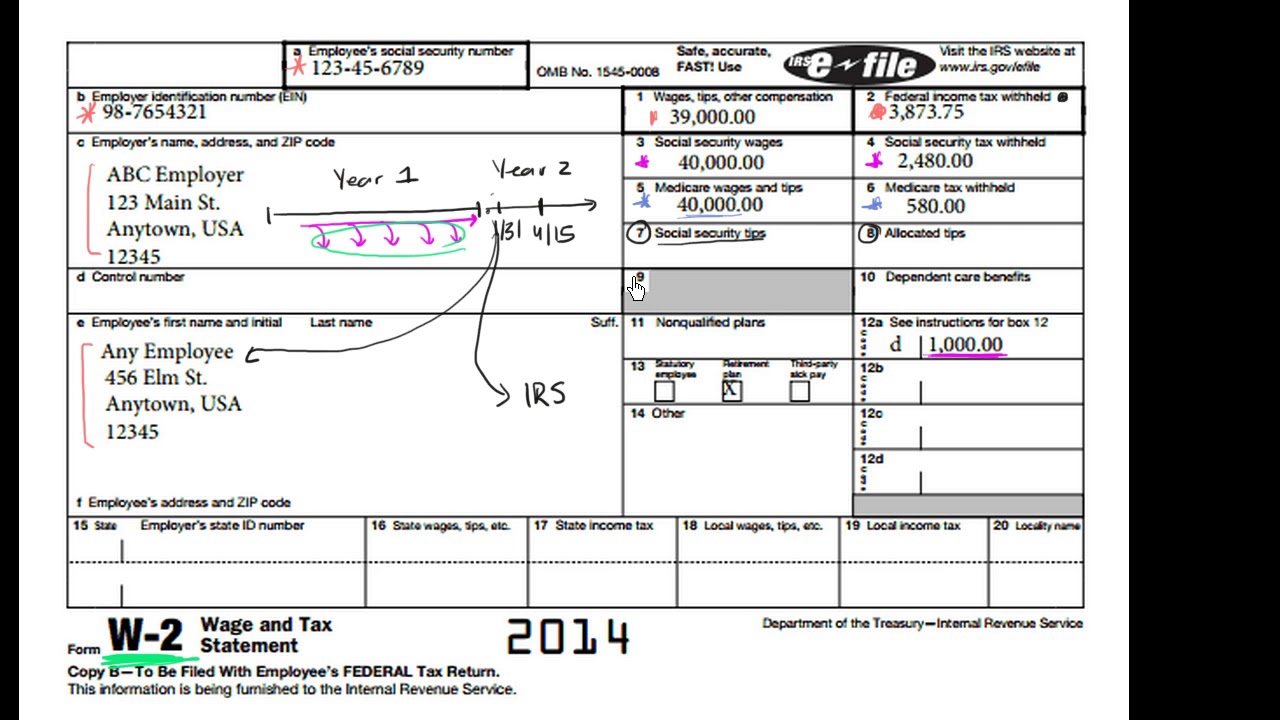

Sample income tax calculation sheet. This calculator will work out income tax and income tax rates for the given years home based childcare ir413 2012 year worksheet for home based childcare service providers to calculate the standard costs available and find out if you are required to file a return of income for payments youve received for providing childcare services. An income tax calculator is an online tool designed to do help with basic tax calculations. The annual income tax payable is then automatically calculated in columns d e based on the specified user input values and the default tax calculation variable amounts which are included on the values sheet including the tax brackets at the top of the sheet.

We highlight the changes and give you the new tax calculator for fy 2019 20 ay 2020 21. Budget 2019 has made some changes to income tax for individual the highlight being full tax rebate for individuals earning below rs 5 lakhs. There is no need to enter sensitive personal information such as your name or social security number.

Example of a standard personal income tax calculation in netherlands. Tax calculators make use of information related to your income deductions and hra exemption to provide approximate figures of income tax to be paid. Income tax is considered as an expense for the business or individual because there is an outflow of cash due to the tax payout.

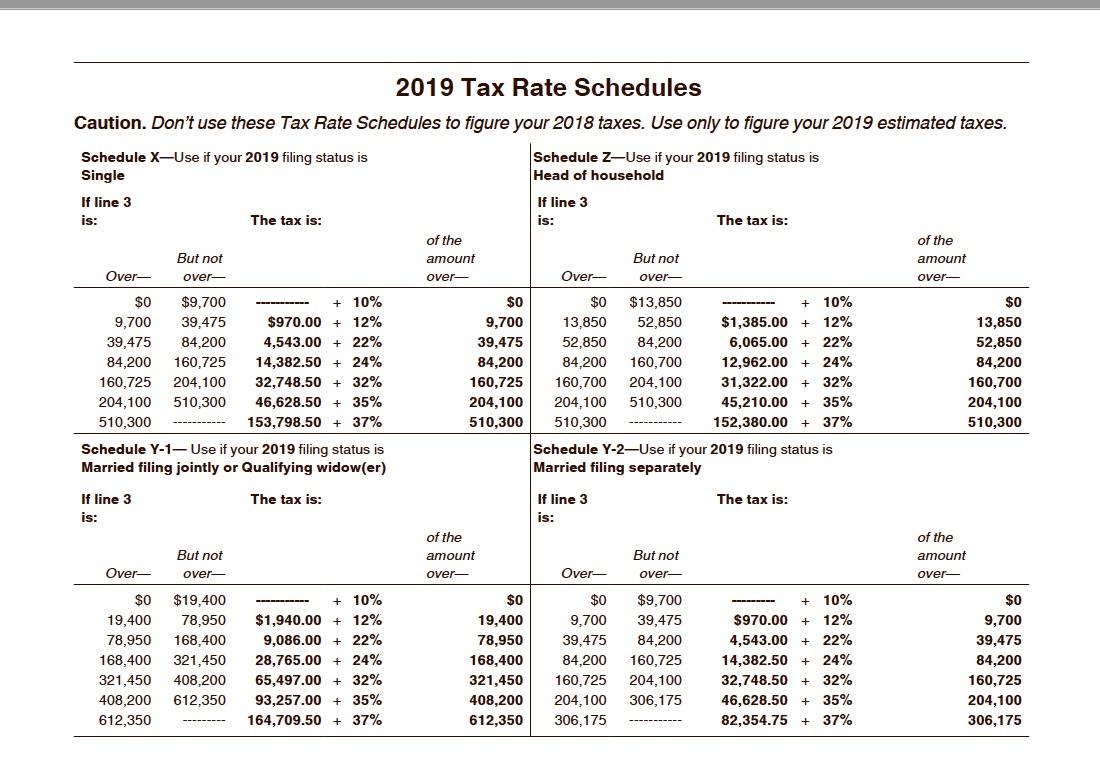

Income tax calculator estimate your 2019 tax refund answer a few simple questions about your life income and expenses and our free tax refund estimator will give you an idea of how much youll get as a refund or owe the irs when you file in 2020. There has been no changes in the income tax slab. Following is the example of computation of taxable income for an individual below the age of 60 years.

The tax calculator looks like a regular irs income tax form and lets you enter your actual or estimated income dependent deduction and tax credit information. In budget 2017 the finance minister has made little changes to this. Income tax for individual is what most tax payers want to know in budget.

Income tax is a type of liability on the business or an individual and is a tax levied by the government on the earnings of a business and the income of an individual.

0 Response to "Sample Income Tax Calculation Sheet"

Post a Comment