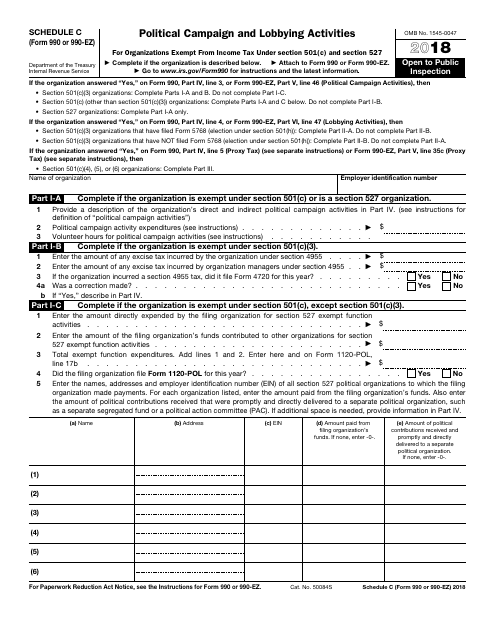

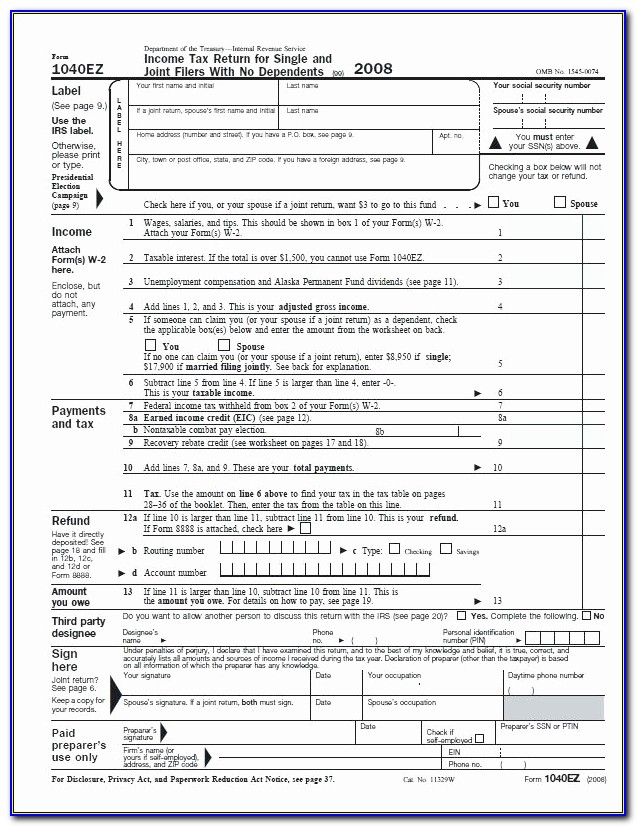

Schedule c form is used to report taxes annually for your yearly income. A schedule c form is a supplemental form that is sent with a 1040 when someone is a sole proprietor.

Free printable 2019 schedule c form and 2019 schedule c instructions booklet sourced from the irs.

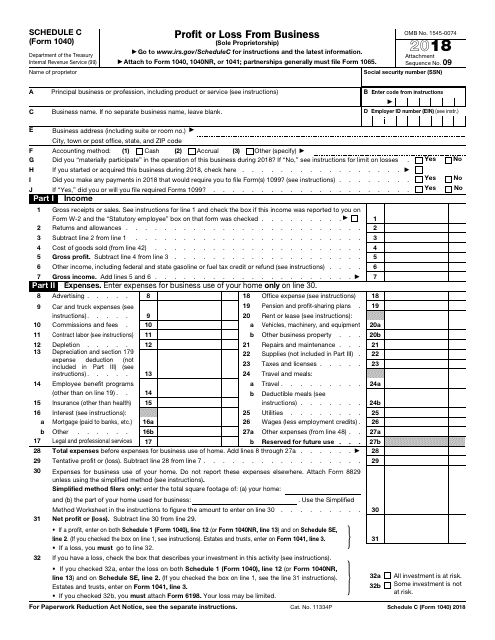

Sample schedule c form. The irs schedule c form is the most common business income tax form for small business owners. The title doesnt have to be anything formal and. Apart from personal details it has a section to record the incomes expenses costs of goods sold other costs like vehicle expenses electricity used and so on.

Anyone in business as an independent contractor or a sole proprietor needs to file an addendum to your personal tax statement form 1040 called schedule c. A schedule c form has two general parts. How to prepare a schedule c.

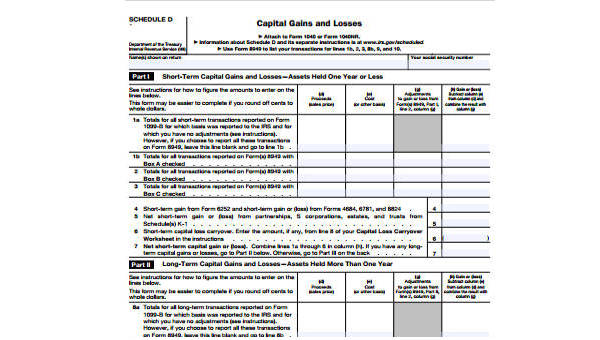

Lower of cost or market c. Methods used to value closing inventory. While your 1040 is a statement of all of your.

Schedule c form 1040 is used to report income or loss from a business operated or a profession practiced as a sole proprietor. The centerpoint of doing your taxes when you have your own business is schedule cthis is where you enter most of your business s income and deductions. Schedule c form 1040 or 1040 sr 2019.

Its used to report income for a sole proprietorship or single member limited liability company llca sole proprietorship reports its business income by completing a schedule c and including the resulting net income figure on the owners personal tax return. Known as a profit or loss from business form it is used to provide information about both the profit and the loss sustained in business by the sole proprietor. Sample schedule c tax form.

Information about schedule c form 1040 profit or loss from business sole proprietorship including recent updates related forms and instructions on how to file. Then calculate your profit or loss from business and attach to form 1040. The schedule c form helps anyone who is self employed calculate the profit or loss of the business for annual taxes which are due on april 15.

Heres the rundown on the schedule c. This form can be used by an organization to calculate its profit and losses in accordance with the tax laws and then submit these to the taxation department. Sample schedule c tax form.

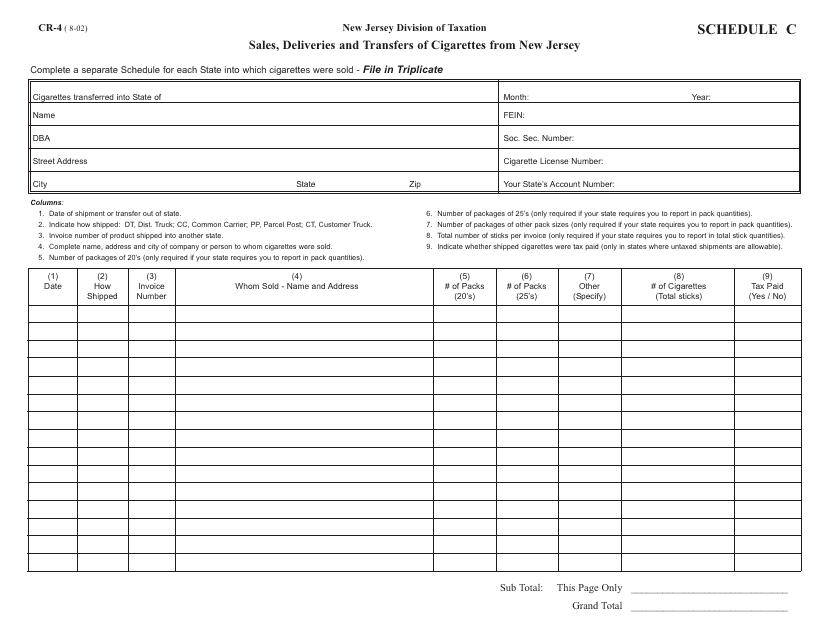

Page 2 part iii cost of goods sold see instructions 33. The format followed is defined and guarded by the taxation law making the process simpler. Let s take a step by step look at filling out the form.

Download and print the pdf file. Schedule c form 1040 is to account and record the profit and loss from a business where one is the sole proprietor. Other attach explanation 34.

Schedule c form 1040 or 1040 sr 2019.

/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)

0 Response to "Sample Schedule C Form"

Post a Comment