Unlike a secured promissory note the lender is taking into account the borrower. If this is the first time you are signing a promissory note then it is good to have a look at it before actually signing it.

A promissory note also sometimes called an iou is essentially a one sided document by which a borrower of money most often just called the borrower agrees to pay a lender the lender.

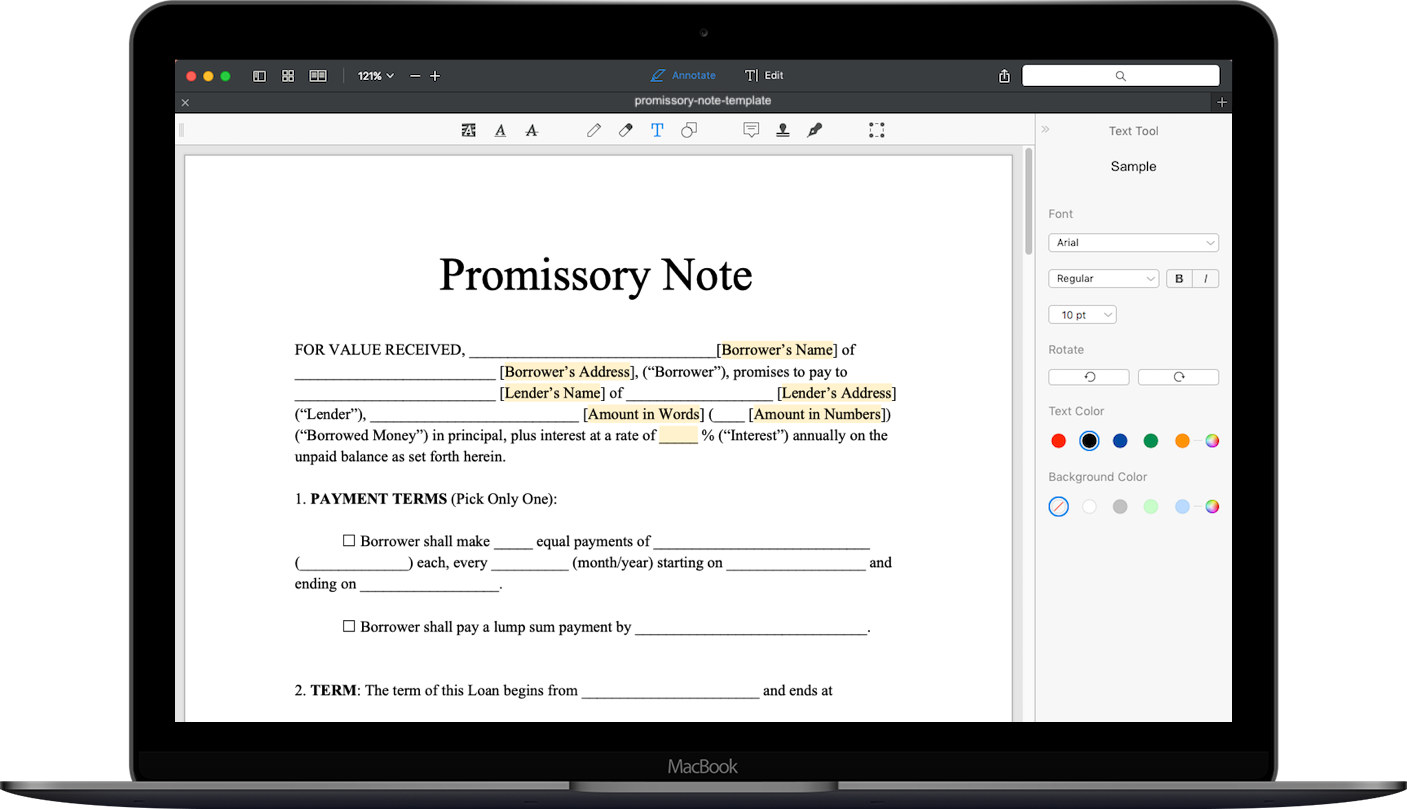

Promissory note template. Therefore to help business owners save time promissory note templates are available on the web for free. A promissory note or promise to pay is a note that details money borrowed from a lender and the repayment structurethe document holds the borrower accountable for paying back the money plus interest if any. If repayment stretches beyond the due date interest will begin to accumulate.

Promissory notes are negotiable instruments that are saleable and unconditional and are used in business transactions around the world. It is a financial tool and it shows the amount of cash the borrower should pay inclusive of interest at a future date. Just like any other promissory note the parties will fill details as required this is important for future reference.

Free promissory note back to previous page. The free promissory note below is downloadable in microsoft word format. Unsecured promissory note template create a high quality document online now.

Loan promissory note template. A simple promissory note is mostly used as a short term loan where one person will lend money lender to someone else borrower. One can use promissory note template word when giving away money to a family member or any other person for short period of time.

A simple promissory note template word sample is a form of financial agreement between a borrower and lender that offers an assurance from the former that he would repay the sum lent along with agreed interest rate to the lender within a set timeline. There are 2 types of promissory notes secured and unsecured. It is a promise to pay a loan made by the borrower.

It is designed for an unsecured loan and it requires that you calculate the amortization repayment schedule interest and payment schedule. These are usually unsecured financial instruments. An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full.

Here is a promissory note template that might be used to sign an agreement or contract with you. A promissory note is required when you have to obtain loan or make promise for a financial transaction to a bank. A promissory note is different than a loan agreement because it only binds one party the borrower to actions such as payment or consequences such as if the borrower doesnt pay but it doesnt bind.

In this legal document one party promises to pay another involved party specific sum of money on mentioned time date or on demand. Once this form is signed with both parties present it becomes legal but is advised that all payments and notifications be copied and saved for each persons records.

0 Response to "Promissory Note Template"

Post a Comment